7.8 Plotting the returns

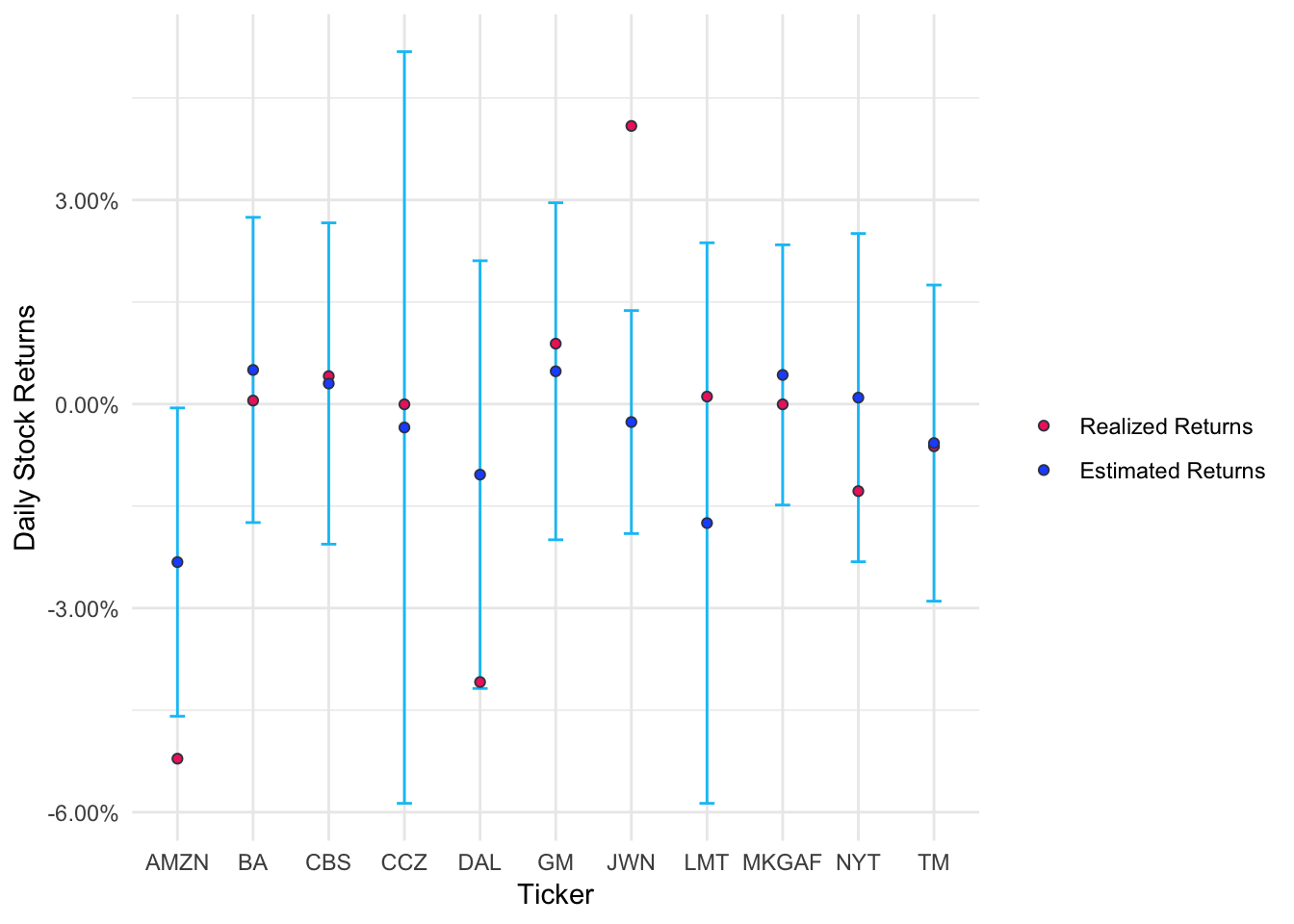

We will now plot the returns for easy comparison. The best way to depict these returns will be by using a scatterplot superimposed on the error bars corresponding to the lower and upper prediction intervals.

We will first create a data set that is reshaped to be long. As the realized returns do not have the prediction intervals, we will drop these variables for the time being.

predictions_lg <- predictions %>%

select(ticker, ret, fit) %>%

reshape2::melt(id.vars = "ticker")Take a look at this data using headTail() function from psych package, which will print 4 observations from the top and 4 observations from the bottom by default.

psych::headTail(predictions_lg) %>%

knitr::kable(caption = "Reshaped Predictions",

booktabs = TRUE)| ticker | variable | value | |

|---|---|---|---|

| 1 | AMZN | ret | -0.05 |

| 2 | BA | ret | 0 |

| 3 | CBS | ret | 0 |

| 4 | CCZ | ret | 0 |

| … | NA | NA | … |

| 19 | MKGAF | fit | 0 |

| 20 | NYT | fit | 0 |

| 21 | JWN | fit | 0 |

| 22 | TM | fit | -0.01 |

Now make the plot.

ggplot(predictions_lg, aes(x = ticker)) +

geom_errorbar(aes(ymin = lwr, ymax = upr),

data = predictions,

color = "#03c3f6",

width = 0.2) +

geom_point(aes(y = value,

fill = variable),

color = "#3b4252",

shape = 21) +

scale_y_continuous(labels = scales::percent) +

scale_fill_manual(values = c("#ef2e69",

"#205aff"),

labels = c("Realized Returns",

"Estimated Returns")) +

labs(x = "Ticker",

y = "Daily Stock Returns",

fill = "") +

theme_minimal()

Figure 7.2: Stock Reactions to Trump Attacks

Interestingly, except for Amazon, no other stock suffered from Trump attack! Nordstrom actually showed an unexpected increase in the stock price. Otherwise, rest 9 stocks have no effect of Trump Twitter attack.